Scholars, former officials, and human rights activists from several countries attended the event organized on the eve of Taiwan’s 78th Judicial Day.

by Marco Respinti

The Forum.

Judicial Day is an important day for Taiwan, one commemorating the importance of justice and the rule of law. It is celebrated on January 11 because, on January 11, 1943, the Republic of China (R.O.C.) entered into a new treaty with the United States and the United Kingdom, making R.O.C.’s judicial system completely independent from any foreign jurisdiction.

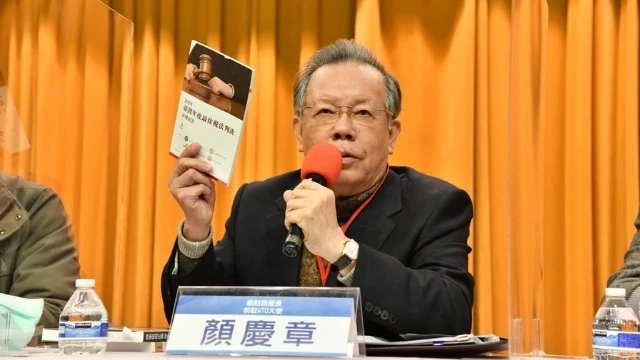

Former Minister of Finance Yen Ching-Chang invited the attendees to a moment of silence for the Judicial Day.

On the eve of the 78th Judicial Day, scholars, former officials, and NGO activists attended the Forum “Review of Judicial Practices: Human Rights and Cases of Injustice,” part of the forum series “True Tax and Legal Reform: Saving Taiwan with Conscience,” to provide recommendations for judicial reform.

The video of the Forum.

Very much present in the mind of the participants was the Tai Ji Men tax case, an issue of freedom of belief as well as of tax justice that resulted in one of the longest sequels of court cases in Taiwan’s history, lasting for 24 years from 1996 to 2020, and still not totally resolved to this day.

Cheng Chung-mo, former Justice and Vice-President of the Judicial Yuan, Taiwan’s highest judicial authority, discussed the problems affecting Taiwan’s judicial system, indicating that there are not enough judges to adequately deal with all cases, which may result in human rights problems.

Cheng Chung-mo: “78 years after the independence of the judiciary, there has been no comprehensive book on the judicial system, practice and theory in Taiwan, because the government does not encourage scholars to write such books.”

Chen Tze-lung, chairman of the Taiwan Association for the Study of Finance Criminal Law, emphasized that judicial reform is not a matter for the president, but for all people, and that all people should participate in the reform process.

Chen Tze-lung: “The Tai Ji Men case is a fabricated case for political reasons, where the presumption of innocence and the principle of legality were not honored.”

Former Minister of Finance and former Representative of Taiwan to the WTO Yen Ching-Chang stressed that a transparent and honest bureaucracy and tax administration is the trademark of a democratic country. The clarity of the taxation requirements and the transparency of the tax procedures are especially important, Yen said, mentioning that the Tai Ji Men case evidenced that this has not yet been achieved in Taiwan.

Huang Chun-Chieh, a former member of the Presidential Office Human Rights Consultative Committee, and a distinguished professor at the Department of Financial and Economic Law of National Chung Cheng University, observed that in the Tai Ji Men case, tax bureaucrats intentionally ignore the clear indications of courts of law. This is not acceptable, Huang insisted, and the National Human Rights Commission should correct such violations.

Huang Chun-Chieh: “Tai Ji Men members are taxpayers who fight for the rights of all.”

Former auditor in the National Taxation Bureau of Kaohsiung Huang Kunguang lamented that the Ministry of Finance itself often is not in a position to correct wrongdoings by tax bureaucrats. He also noted that the latter receive bonuses for their tax bills, a system that may encourage them to become greedy and unfair.

Huang Kunguang: “In order to save others, Tai Ji Men should file a lawsuit for national compensation for being victimized by illegal taxation.”

Yen Ching-Chang added that, in addition to the transparency of the various stages of the taxation process, and even more importantly, a democratic country must give taxpayers an opportunity to reasonably express their views, and taxpayers’ complaints must be taken seriously, which clearly did not happen in the Tai Ji Men case.

Professor Wu Chih-kuang, from the Law School of Fu Jen Catholic University, argued that in the case of Tai Ji Men when new evidence has emerged, naturally it is necessary and beneficial to apply for a new administrative procedure under Article 128 of the Administrative Procedure Act.

Former Supreme Administrative Court judge Lin Wen-Chou said that withdrawing funds from tax evasion penalties and using them as bonuses for tax officers encourages greed and motivates tax officers to impose penalties on the people. He said that the maximum bonus for an enforcement officer is 1.3 times his/her monthly salary. He also pointed out that civil servants can get rewards when performing their duties well, so it is unfair for them to receive additional bonuses.

Lin Wen-Chou speaks at the Forum.

Associate Professor Lin Tsan-du, from the Department of Law at the College of Finance and Economics of Aletheia University, pointed out the procedural mistakes in the 2020 auction and seizure of properties belonging to Dr Hong Tao-tze, the Grand Master (Shifu) of Tai Ji Men. He regards the auction and seizure as hasty.

Dr. Hong himself spoke at the event, in his capacity as Vice-President of the United Nations ECOSOC-accredited NGO Association of World Citizens. Hong said that, according to survey results released by the Judicial Yuan, the public’s trust in court cases and the judiciary in Taiwan have improved in 2020, which is encouraging. However, Hong noted, the real essence of judicial reform lies in the government’s willingness to redress injustices and mistakes of the past, and not to repeat them.

Foreign scholars also joined the event, if only by video due to the COVID-19 international pandemic. Dr. Massimo Introvigne, founder and director of CESNUR, the Center for Studies on New Religions, and editor-in-chief of Bitter Winter, examined the interaction of the two foundational principles of solidarity and subsidiarity, which in the West are regarded as the cornerstones of tax justice. This interaction, he said, unfortunately failed in the Tai Ji Men case. His speech has been published in Bitter Winter.

Dr. René Wadlow, president of the Association of World Citizens, Professor Kenneth Jacobsen, from the School of Law of Philadelphia’s Temple University, and Willy Fautré, from Brussels-based NGO Human Rights Without Frontiers, also returned to the Tai Ji Men case as a crucial incident both for religious liberty and tax justice. The two fields may seem far apart, they said, but what happened in the case of Tai Ji Men proves that they are connected. And the fact that so many distinguished speakers at the Judicial Day Forum mentioned the Tai Ji Men case is in itself evidence of the international attention it continues to attract.

They mentioned that, in November 2020, during the third Ministerial to Advance Freedom of Religion or Belief, organized by the U.S. Department of State and others, with the support of foreign ministers from 90 countries around the world, the Tai Ji Men case was discussed in one of the most well-attended side events, with many international human rights scholars and experts participating.

The Tai Ji Men case discussed as the third Ministerial.

Source: Bitter Winter