What is the Tai Ji Men case, and what the Tai Ji Men case is not?

What is the Tai Ji Men case and what the Tai Ji Men case is not. The Tai Ji Men case is a case of freedom of religion or belief (FORB) which we can divide in four times time…

Revealing the Truth of Tai Ji Men Case

The fabricated prosecution of Tai Ji Men Case started in 1996. The persecution due to the illegally revolved tax bills for 25 years has made the case an iconic indicator of human rights violation in Taiwan.

On July 13, 2007, the 3rd instance ruling of the criminal court specified that Tai Ji Men is not guilty. Tai Ji Men did not commit tax evasion, and did not violate the Tax Collection Act. Those earlier falsely detained Tai Ji Men dizi and Zhang-men-ren were ruled to be compensated by the Nation.

Yet to date, the Taxation Bureau keeps sending Tai Ji Men the same tax bills over and over again, and even transferred the case to the Administrative Enforcement Agency for illegal seizure and auction…

What is the Tai Ji Men case, and what the Tai Ji Men case is not?

[ The History of Tai Ji Men Case ]

- 1996

1. The history of Tai Ji Men tax case of injustice

After its first direct presidential election in 1996, the Taiwan government conducted a political purge in the name of religious crackdown. Prosecutors and tax officers jointly falsified the Tai Ji Men case, trying to exterminate Tai Ji Men. At the time, Tai Ji Men was stigmatized by more than 400 untrue news reports, which created a widespread perception of guilt before the trial began. As a result, tens of thousands of families fell victim to this political purge and their human rights were seriously violated. Scholars called the case “the February 28 incident in judiciary and taxation.”

- 1996

2. Prosecution without evidence Unlawful 4-month detention by the prosecutor

In November 1996, because of an ungrounded report, Kaohsiung and Hsinchu District Prosecutors Offices carried out investigations into Tai Ji Men. Results collected showed nothing was unlawful and there were no victims in this case. The case was therefore closed then. However, on December 19, prosecutor Kuan-Ren Hou led hundreds of police officers, who carried weapons, to search all chapters of the Tai Ji Men Qigong Academy and the private residences of several Tai Ji Men dizi (similar to students), and then unlawfully detained the Zhang-men-ren (grandmaster) of Tai Ji Men for four months.

- 1997

3.The prosecutor fabricated an indictment NTB issued unjustified tax bills based on fabricated numbers

On April 18, 1997, the prosecutor accused the Zhang-men-ren of violations of the tax collection act and tax evasion. Additionally, the prosecutor fabricated crimes of fraud and tax evasion and made up false amounts of money in the indictment. He falsely claimed that the money was proceeds from fraud and requested it be confiscated, but at the same time he also falsely claimed that the same money was tuition income and business revenue and transferred the case to the National Taxation Bureau (NTB).

- 1997-2020

4.NTB issued unjustified taxes without evidence

Aware of the contradictions in the nature of the income in the indictment, the NTB failed to wait for the court’s decision about the nature of the red envelopes given by Tai Ji Men dizi to their shifu, failed to exercise due diligence to verify the nature of the income involved, and failed to verify the statements from the people concerned. After ten years, the criminal court of third instance found all the defendants in the Tai Ji Men case not guilty of fraud, tax evasion, or violations of tax codes. The Ministry of Education already explained on three occasions that Tai Ji Men is not a cram school. According to the resolution of the inter-departmental meeting of the Executive Yuan, the taxation bureau should have revoked the tax bills and terminated the Tai Ji Men case. However, the taxation bureau disregarded the resolution of the meeting and continued to issue unjustified tax bills.

- 1997-2007

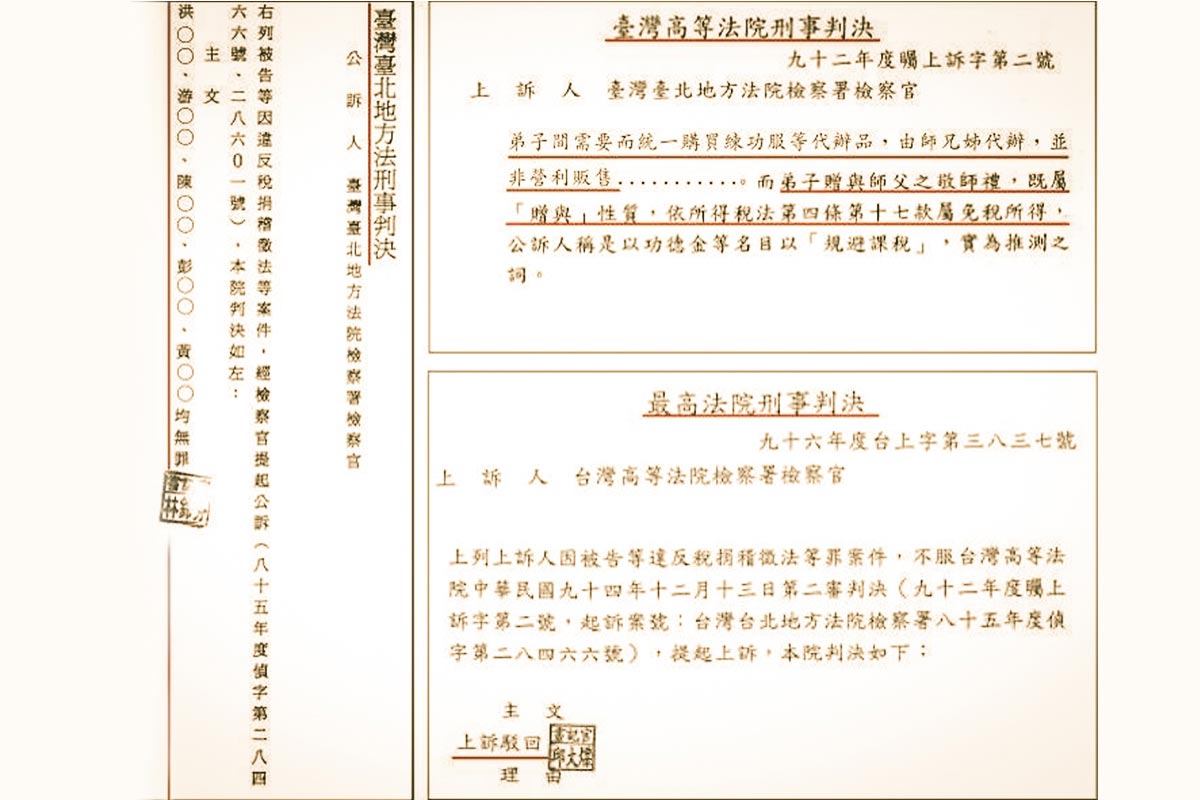

5.Criminal trials spanning 10 years and three months Final judgement: Not guilty, No Tax Evasion, No Violation of Tax Codes

After criminal trials spanning10 years and 3 months, the Supreme Court rendered a final not-guilty decision, which confirmed that there was no fraud, no tax evasion, and no violation of the Tax Collection Act. On July 13th, 2007, the criminal court of third instance found all the defendants in the Tai Ji Men case not guilty of fraud, tax evasion, or violations of tax codes. It was further acknowledged that “since the red envelopes offered by the dizi to the shifu were gifts, they were tax-free income under Article 4, Subparagraph 17 of the Income Tax Act,” and “items such as the uniforms for practicing qigong, which were collectively procured by certain Tai Ji Men dizi out of the needs of the dizi, were not sold for profits” and have nothing to do with the Zhang-men-ren (grandmaster) of Tai Ji Men and his wife. The court confirmed the fact that there was no taxable income.

- 1996-1997

6.The defendants were proved innocent again when receiving national compensation for unlawful imprisonment

From December 21, 1996 to April 16, 1997, during the four-month detention period, about 117 days, prosecutor Hou only summoned the Zhang-men-ren three times, asking only 13 questions lasting only a total of 29 minutes and then released the indictment. In 2002, the Control Yuan started to investigate prosecutor Kuan-jen Hou’s handling of the Tai Ji Men case on its own accord, outlining eight major violations of law. In 2009, the innocent defendants were awarded national compensation for unlawful imprisonment.

- 2011

7.NTB disregarded the public survey results

In 2011, the Executive Yuan held an inter-departmental meeting, which reiterated and resolved that the taxation bureau must not impose taxes on Tai Ji Men based on the indictment of the criminal case, and it was resolved that the taxation bureau should investigate the nature of the red envelopes. The 7,401 survey forms received all stated that Tai Ji Men dizi’s red envelopes for their shifu were gifts, consistent with the criminal court’s decision. However, the taxation bureau disregarded the resolution of the meeting and continued to issue unjustified tax bills.

- 2018

8.Tai Ji Men won 18 times while pursuing administrative remedies, but the unjustified tax bills remain

Over the 24 years, Tai Ji Men has followed legal procedures to seek administrative remedy. Even though the Petitions and Appeals Committee and the Administrative Courts have made decisions in favor of Tai Ji Men for 18 times, the taxation bureau has still ignored the court’s decision and continued to repeatedly issue tax bills. The Supreme Administrative Court’s Judgment No. 422 in the year 2018 recognized that Tai Ji Men is a men-pai (similar to school) of qigong, martial arts, and self-cultivation. The 7,401 survey forms received all stated that Tai Ji Men dizi’s red envelopes for their shifu were gifts, consistent with the criminal court’s decision.

- 2019

9.There is only one truth, no gray area

At the end of 2019, the NTB corrected the tax amount for the red envelopes for the year 1991 and the years 1993-1996 to zero, based on the Supreme Administrative Court’s Judgment Pan-Tzu No. 422 in the year 2018, Taipei High Administrative Court’s decision Su-Tzu No. 76 in 2014, and the Taxpayer Rights Protection Act, consistent with the criminal court decision. Tai Ji Men dizi originally thought that the entire Tai Ji Men tax case could be closed. However, the NTB violates the principle of consistency by treating the red envelopes for the year 1992 as cram school tuition. The NTB has continued to impose unjustified taxes on Tai Ji Men and transfer the case for compulsory enforcement. All evidence and facts have shown that Tai Ji Men was not guilty of tax evasion or violation of tax codes and that Tai Ji Men has never been a cram school. By collecting unjustified taxes, the NTB is committing the crime of unlawful expropriation under Article 129 of the Criminal Code. Justice cannot be compromised, and there is no gray area. The NTB should immediately revoke the compulsory enforcement and cancel its unlawful tax disposition pursuant to the law to return justice to Tai Ji Men and let taxpayers’ human rights prevail in Taiwan.

10.One should not pay any unjustified tax, not even a penny

Tax lawyers stated that due to the Tai Ji Men case of injustice, people in Taiwan started to value and protect taxpayers’ rights. It has facilitated taxpayer’s human rights protection in Taiwan. Over 24 years, NTB has wasted large amounts of executive and judicial resources and incurred high social costs. NTB has severely violated the taxpayers’ human rights. Tai Ji Men has insisted on doing what is right, hoping to awaken the conscience in administrative and judicial officers and uphold justice in taxation.