The American Senator fought both for religious liberty and tax reform. His lesson is relevant for the Tai Ji Men case.

by Marco Respinti*

*A paper presented at the hybrid seminar “Abusive Taxation and Denial of Justice in Taiwan. Tai Ji Men: A Case of Abusive Taxation of Individual Gifts,” co-organized by CESNUR and Human Rights Without Frontiers in Brussels at the Press Club Brussels Europe on May 4, after the United Nations World Press Freedom Day (May 3).

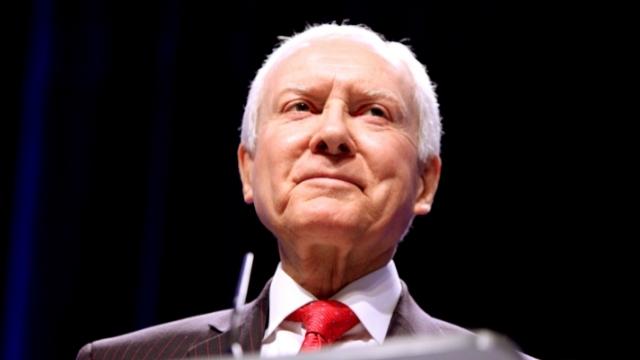

U.S. Senator Orrin Hatch (1934–2022) passed away on April 23, 2022, one month after having turned 88. For those familiar with US politics, Sen. Hatch incarnated the Congress itself: he seemed to have been “there ever since,” and destined to be “there forever.” When he retired from Congress in 2019, after 42 years in office, he was the longest-serving U.S. Senator from the Republican Party in the history of the Senate. Now that he is gone from this earth, his important legacy of principled politics lives on.

A son of Pennsylvania, he relocated in Utah, “the Mormon state,” which he represented in the federal Senate. A devout member of The Church of Jesus Christ of Latter-day Saints, an attorney turned politician, he was a conservative politician, as evidenced inter alia by his stand on abortion.

At least two of Senator Hatch’s contributions to public politics should be celebrated today. First, his lifelong commitment to religious freedom, a constitutional principle that he held in high esteem and never betrayed. Hatch’s conservative persuasions led him to share the position of those constitutional conservatives for whom, on the one hand, to be an American, and proud of it, means to be a standard bearer of religious freedom as enshrined in the First Amendment of the US Constitution, and, on the other hand, to regard the defense of religious liberty as an unalienable, distinctive tract of a true loyal American patriot.

Senator Hatch’s devotion to religious liberty was of course motivated by his legitimate will to defend his church’s prerogatives, but it was always exerted to the benefit of all confessions and religious persuasions.

His second contribution was his leadership in the fight to hold the US Internal Revenue Service (IRS) accountable, after IRS bureaucrats leaked information about donors to non-profit advocacy groups. This caused embarrassment to many of those donors (especially when the cause they supported was delicate or controversial) and thus resulted into economic damage for the advocacy organizations.

Hatch understood that these leaks did not happen by coincidence, and were an attempt by some tax bureaucrats to damage certain movements for ideological or political reasons. The Senator reminded the IRS that nobody, not even a powerful tax agency, is above the law.

As attorney Cleta Mitchell, a partner in the Washington, D.C., office of Foley & Lardner, who represented many of the advocacy and activist groups targeted by the IRS, noted in November 2014 in The Wall Street Journal, “Congress should rein in the Internal Revenue Service.” “Bringing the IRS to heel,” Mitchell explained, “can start with re-energizing and expanding congressional investigations and holding accountable those responsible for the targeting and other abuses.”

At that time, in November 2014, right after mid-term elections gave the Republican Party control of both Houses of the Congress, among the top investigative priorities of the American Parliament were, according to Mitchell, the ideologically based tax audits performed, possibly illegally, by certain IRS bureaucrats, “[t]he IRS seizure of taxpayer assets and bank accounts without due process;” “[t]he illegal disclosure of confidential taxpayer information to the media, to other federal agencies and to state and local partisan political officials.”

I quote this article because it shows that the tendency by some tax bureaucrats to act illegally for ideological reasons is not a Taiwanese problem only. In the United States, as it happened in Taiwan thanks to Tai Ji Men, citizens mobilized for tax reform. Senator Hatch was one of their staunchest supporters.

One of the most active and effective advocacy group in America is called Americans for Tax Reform, an organization based in Washington, D.C. It has partners in the whole world and has cooperated with Senator Hatch and like-minded members of the Congress. Led by Grover Norquist, it was remotely inspired by President Ronald Reagan (1911-2004), who in 1981 was the author of the largest tax-cut in US history and did much to contain the intrusive power of the tax agencies.

Senator Hatch’s two main interests, tax reform and religious liberty, eventually came to meet. He was well aware that the IRS abuses often targeted religious and spiritual movements, or religiously motivated advocacy groups, which for whatever reason some tax bureaucrats did not like.

Americans for Tax Reform are well aware of the Tai Ji Men situation in Taiwan, also because I alerted them myself to the importance of the case. There is much that can inspire Tai Ji Men and their friends in the political career of Senator Hatch, especially when it comes to present the Tai Ji Men case to American audiences.

A first point is that there is a sort of inertia, as Italian economist Pier Marco Ferraresi once called it when discussing the Tai Ji Men case, which leads tax bureaucrats who have made mistakes, or even have acted in bad faith, to continue on the same path unless somebody stops them. Senator Hatch understood it, and acted decisively, together with other activists and lawmakers, to rein the IRS in after it had abused its power, an important lesson for Taiwan.

Second, Senator Hatch taught us that an abusive tax system is particularly dangerous for freedom of religion or belief. Religious and spiritual movements are vulnerable, and ideologically motivated bureaucrats can do much damage to them.

Tax reform and the defense of freedom of religion or belief are inseparable. This was the “good battle” of Senator Orrin Hatch. The best way of remembering him is to apply his lesson to all cases in the world where tax abuses become a toll to deny freedom of religion or belief. It is what is happening today in the Tai Ji Men case.

Source: Bitter Winter